Please speak with a participating lender for details. Won't affect your credit score.

Credit Score Information For Kentucky Home Buyers Buying First Home Home Buying Checklist Home Buying Process

Fha guidelines allows a borrower with a minimum credit score of 580 to buy a home using their own funds for a down payment or the.

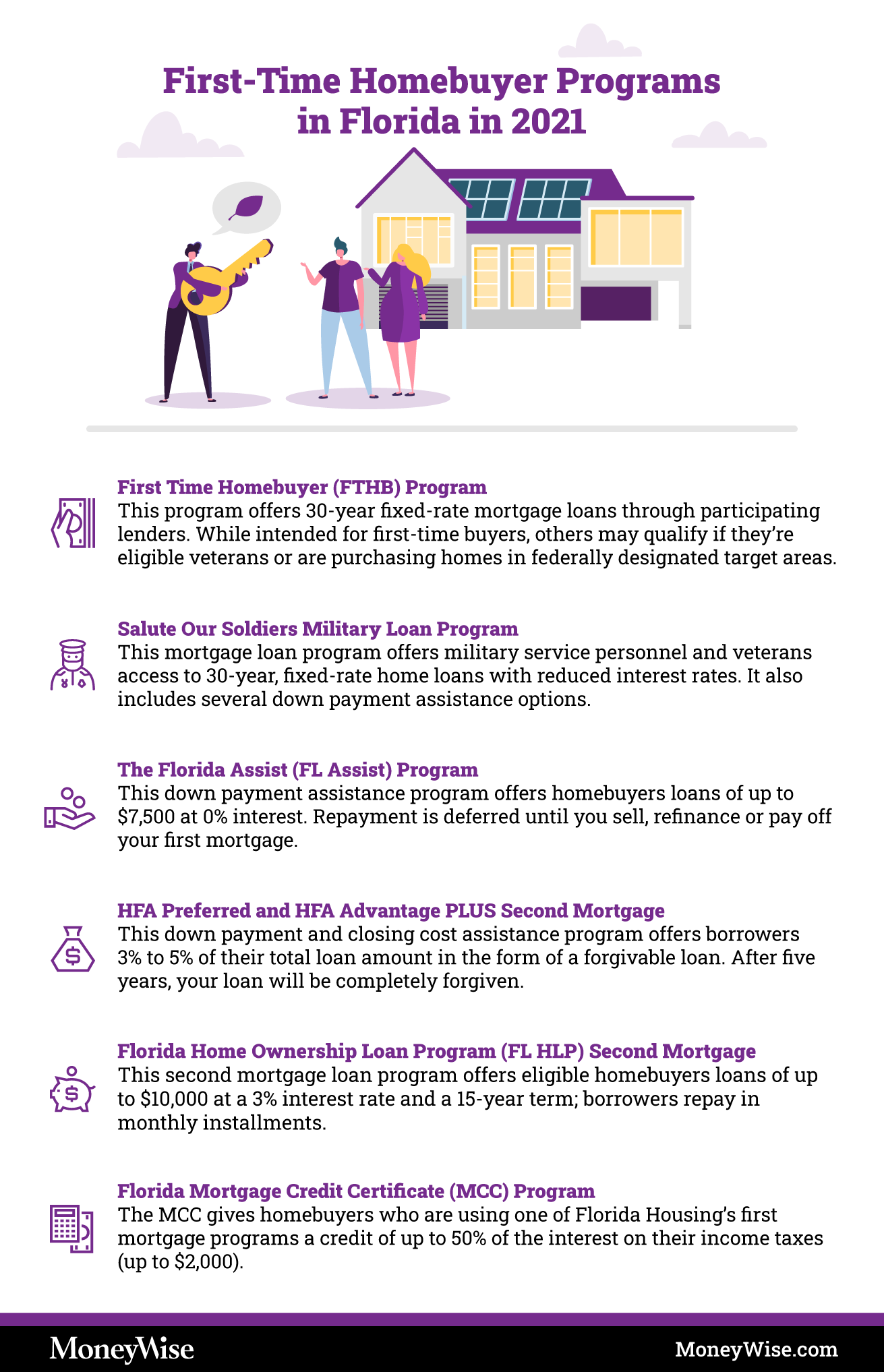

First time homebuyer program florida credit score. Although not a direct mortgage program, the florida housing mortgage credit certificate helps first time home buyers in florida and veterans save on their annual federal income taxes based on how much they pay in mortgage interest. Fha guidelines requires a minimum credit score of 500 for all loans. Florida first time home buyer program.

Perhaps you made some poor financial decisions in your younger days that brought down your score , or maybe you are still in your younger days right now and simply haven't had time to build up your number. Buyers using the conventional bond program have the choice to receive a grant equal to 3% of the sale price of the home and. If you qualify, you can reduce your federal taxes up to $2,000/year from mortgage interest paid.

Fha loan qualification is not as stringent when it comes to credit score. Bigger the bank, higher the rate. The upfront 2% usda guarantee fee may be added to the usda loan amount.

10/1 adjustable rate mortgage 97% ltv first mortgage loan with low interest rate. It could cost you thousands and we see them made everyday. Let's translate that into some real numbers:

And retirees — with as little as 5% down. Fha guidelines allows a borrower with a credit score of 580 to buy a home with only a 3.5% down payment. Up to 5% of the purchase price, from $1,500 to maximum $6,500.

Second mortgage, 0% interest rate, deferred repayment. Borrowers need just a 3% down payment. Without affecting your credit score.

Income cannot exceed 100% of the area median income (ami). In florida, the maximum usda loan amount is $417,000. First time buyers & more.

Mboh plus 0% deferred down payment assistance program. Down payments for conventional mortgages usually hover above 20%. Make your dream of owning a home come true with our first time homebuyer 10/1 arm program.

Some first time programs have income limits, but do not worry youe loan officer will review all loan program options with you. In fact, a credit score of around 580 can qualify you for an fha loan with a 3.5% down payment. The process of purchasing your first home can be daunting and expensive, and it will likely include many financial situations you've never encountered.

Under this first time florida homebuyer program 100% financing is available with no monthly mortgage insurance premium charged to the first time florida home buyer. (christine donaldson / unsplash) if you have… no credit score. Suncoast will pay up to $3,000 toward your qualifying closing costs** when you purchase or refinance your primary residence with our first time homebuyer 10/1 adjustable rate mortgage (arm).

Your application may be considered even if your credit score is as low as 580 (with a 3.5% down payment) or 500 (with a 10% down payment). The mcc gives homebuyers who are using one of florida housing's first mortgage programs a credit of up to 50% of the interest on their income taxes (up to $2,000). First time home buyer programs in florida.

New and improved program for first time homebuyers.

Florida Down Payment Assistance For First Time Home Buyers

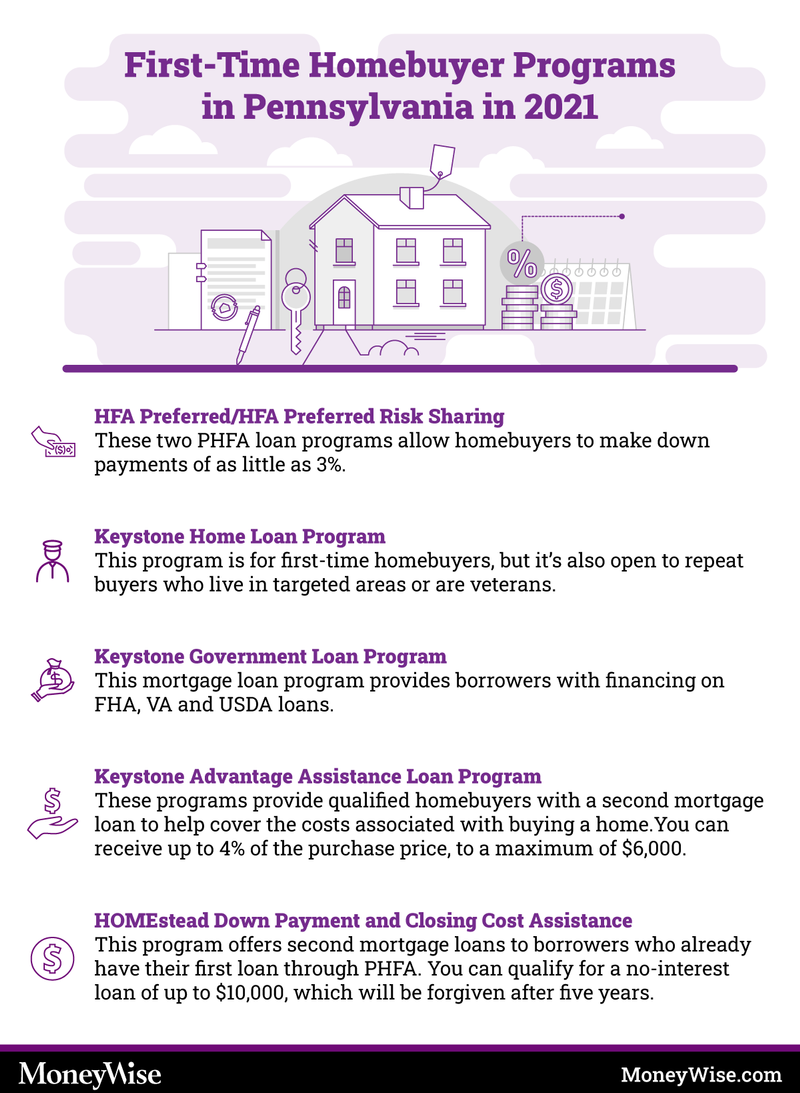

First-time Homebuyer Programs In Pennsylvania Pa 2021

First-time Homebuyer Programs In Arizona 2021

First Time Homebuyer Grants And Programs Nextadvisor With Time

First-time Homebuyer Grants And Programs In Florida

First-time Homebuyer Programs In Florida 2021

Tips For First-time Home Buyers What You Must Know Before You Buy

Minimum Credit Scores For Fha Loans

The Key To Getting Your First Home

Common Mistakes That First-time Home Buyers Make Buying First Home First Time Home Buyers First Home Buyer

Acceptable Income And Job History For A Mortgage Loan Approval In Kentucky Buying First Home Real Estate Infographic Real Estate Tips

Florida Realty Will Sell Your House For Only 995 Charged At Closing When Your Property Sells No Sellers Commissio Buying First Home Home Buying Real Estate

Tips For First-time Home Buyers What You Must Know Before You Buy

First Time Homebuyer Programs In Florida

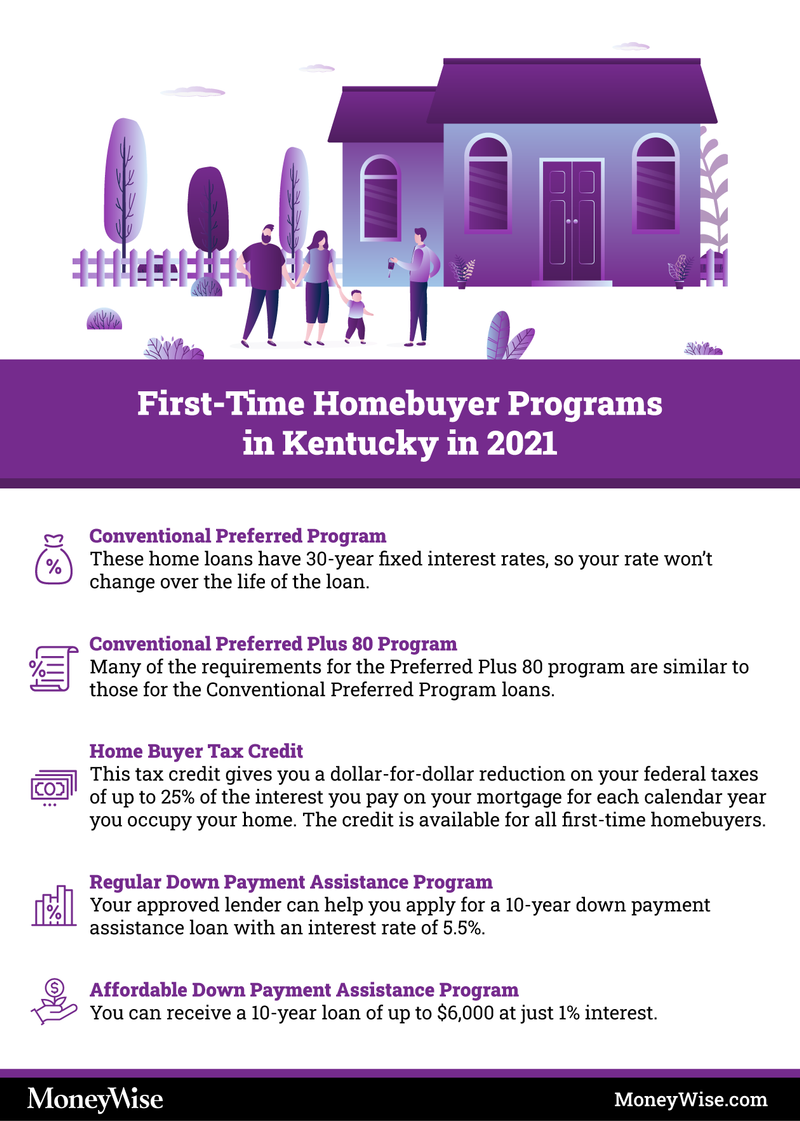

First-time Homebuyer Programs In Kentucky 2021

First-time Homebuyer Grants In Florida Marimark Mortgage

What New Home Buyers Need To Know

First Time Home Buyer Loan 3 Down Best Rates First Florida

Credit Score Information For Kentucky Home Buyers Credit Score Mortgage Loans Buying First Home

First Time Homebuyer Program Florida Credit Score. There are any First Time Homebuyer Program Florida Credit Score in here.