Auto loan preferred interest rate discount of 0.25% to 0.50% is based on reward tier and valid only for enrolled preferred rewards members at the time of auto loan application who obtain a bank of america auto purchase or refinance loan. A down payment is not typically required for your loan, but making one is usually a good idea:

Pin By Amy Jo Larsen On Loan Applications Mortgage Process Mortgage Loans Mortgage Loan Originator

If you don't have a monthly budget, a good time to create one is when you're considering the purchase of a car.

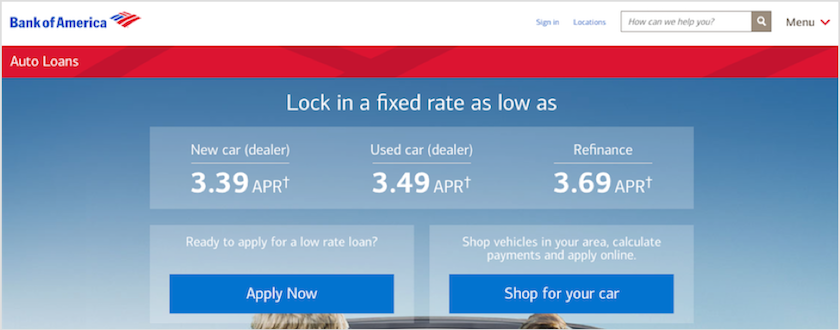

First time car buyer loans bank of america. Then, go online to see what kinds of cars you could get for your budget and narrow down to the makes and models that fit your needs. You must select the car you want to buy before applying for financing. Their rate sheet displays three tier levels:

We offer first time car buyers loan. Will need to provide proof of income With the first time car buyers loan program, you get the opportunity of building your credit score to new heights.

You can also refinance your existing vehicle loan to acquire a lower rate or payment. *terms, eligibility & conditions apply. Must be 18 years or older;

So thats going to be $465 times 36. Bank of america auto loan rates and fees. If you have bad credit, you can improve your credit score.

Your down payment, age of the car, and the term length may also affect the rate. Multiple factors will affect your interest rate, including your credit score and income. Start by figuring out how much you can pay for the car.

Also, look for a car loan with no prepayment penalty. Get the car, truck, or suv that you need with fast financing from america first. Save time by shopping for.

For the first few years, with a new car, you probably wont need to do much more maintenance than thisif you do, it might be covered by your warranty. Receive a loan decision for the vehicle you chooseit's fast and easy with bank of america. What down payment does a.

(in general, for every $1,000 you put down, your monthly car payment generally drops by $15 to $18, according to november 2017 data from edmunds.) You can use the bank of america auto loan calculator to see how different loan amounts, aprs and terms will affect your monthly payment. The average first time car buyer tends to pay a higher apr due to lack of credit history.

It might be your first auto loan, but it's not our first rodeo. If youre planning to finance it, determine a monthly car payment you can afford. Depending on what kind of car youre buying and your own personal financial situation, you may want to consider one of the following loans:

Customers that fit with one of those credit tiers will need a minimum credit score of 620. This will save you money if you decide to pay off your loan early or refinance your car loan. $2,500 minimum and a $15,000 maximum loan amount;

The maximum preferred interest rate discount on a bank of america auto loan is 0.50%. We want that first car purchase excitement to last much longer than that fresh new car scent. As mentioned above, bank of america loans to a+, a, b and very upper level c tier credit.

You wont have to borrow as much, and your monthly payment will be lower. We'll show you the ropes! At enterprise car sales, we can help you find rates and terms that work for you.

Bank of america today announced it will triple its affordable homeownership initiative to $15 billion through 2025, aiming to help more than 60,000 individuals and families to purchase homes. So that one hundred sixty dollars a year may be worth it over time. As of the writing of this article, bank of america car loan rates start at:

Find a car and apply online today! The maximum amount is limited to $150,000, dependent on a customers income, credit score, and the vehicle. So this is essentially the total amount that you would have to put to keep the car outright.

Car loan with a cosigner. With a private party auto loan, a lender loans you money to buy a car from a private seller. If this is your first time borrowing, you might have an easier time qualifying if you apply with a cosigner.

$465 a month times 36 months and then you dont have to pay anything after three years, you will own your car outright. Well first step is the create your budget. Bank of america requires auto loan borrowers to finance a minimum of $7,500 (or $8,000 in minnesota).

From the brilliant color to that feeling of the ground beneath you as you obey the speed limit, experiencing your first vehicle is a rush of excitement. If approved, the lender typically pays the seller or lienholder the amount you owe, then you repay the lender, with interest, over the term of the loan.

Buying A Car With Bad Credit Creditcom

Whats The Average Car Loan Length Credit Karma

Pin On The Kcm Crew Espanol

If Youre Looking To Buy A Home Youll Want To Find A Place That Fits Your Budget Too Ask Yourself These Three Q Home Buying Home Buying Tips Home Ownership

You May Be Satisfied With The Conditions Of Your Car Loan But In Fact It Can Always Be Made More Profitable Did You Eve Refinance Car Car Buying Car Finance

Customer Support From Loan Companies How Is It Loan Company Loan Car Loans

13 Instant Approval Auto Loans For Bad Credit 2021

/man-giving-girlfriend-keys-to-car-514409819-582d1f1b5f9b58d5b18fd329.jpg)

Can Someone Take Over My Car Loan

An Overhead View Of Toy Car Over Calcula Free Photo Freepik Freephoto Background Business Sale Car Car Finance Car Loans Car Title

Comparing Car Financing Through A Bank Vs A Dealer

Bank Of America Auto Loans Review Lendedu

Car Loans For Teens What You Need To Know Credit Karma

How To Get A Used Car Loan - Experian

How To Get A Car Loan With Fair Credit - Nerdwallet

Features Benefits Car Loan Loans Bank Of Ireland

Whats The Catch With Zero Percent Financing Car Loans - Autotrader

12 Best Credit Unions For Car Loans Gobankingrates

Ahahahhahaha Buy Used Cars Car Buying Car Insurance

You Are Tired Of Travelling By Bus Or Any Other Means Of Transport And You Feel That You Are Ready To Buy A C Bad Credit Car Loan Car Loans Car

First Time Car Buyer Loans Bank Of America. There are any First Time Car Buyer Loans Bank Of America in here.