A qualified institutional buyer (qib) is a type of investor that is assumed to be a sophisticated investor and in little need of regulatory protection. Eligible qualified institutional buyers (qibs) were given the share at an issue price of rs 33.75 per unit aggregating to rs 1,799.99 crore, pnb said in a regulatory filing.

Bank Of India Announces Closure Of Qip Issue Raises Rs 2550 Cr - The Financial Express

Qualified institutional buyers are those institutional investors who are generally perceived to possess expertise and the financial muscle to evaluate and invest in the capital markets.

Qualified institutional buyers india. [3] qualified institutional buyers are those institutional investors who are generally perceived to possess expertise and the financial muscle to evaluate and invest in the capital markets. The securities and exchange board of india has defined a qualified institutional buyer as follows: The move to open security receipts to the public is supported by the government, as demonstrated by the finance ministers 2017 budget speech.

Qualified institutional buyers (qibs) shall bring at least 10% margin while submitting the bids. Canara bank on monday said it has set a floor price of rs 103.50 per share for its qualified institutional placement (qip) to raise up to rs 2,000 crore. A company whose equity shares are listed on a stock exchange having nation wide trading terminals and which is complying with the prescribed requirements of minimum public shareholding of the listing agreement will be eligible to raise funds in domestic market by placing securities with qualified institutional buyers (qibs).

Explanation ii.qualified institutional buyer means the qualified institutional buyer as defined in the securities and exchange board of india (issue of capital and disclosure requirements) regulations, 2009, as amended from time to time, made under the securities and exchange board of india act, 1992. The change from qualified institutional buyers to qualified buyers is crucial as it comes with the implication that the public will be allowed to purchase security receipts. Out of the existing 50% portion available for qualified institutional buyers, 5% thereof shall be specifically available for mutual funds registered.

The qualified institutional buyers belonging to the same group or who are under same control shall be deemed to be a single allottee. (ii) a 10[foreign portfolio investor other than category iii foreign portfolio investor], registered with the. (i) a mutual fund, venture capital fund[, alternative investment fund]9 and foreign venture capital investor registered with the board;

Of this, up to 75 per cent of the shares have been reserved for qualified institutional buyers or qibs while 15 per. Any of the following entities, acting for its own account or the accounts of other qualified institutional buyers, that in the aggregate owns and invests on a discretionary basis at least $100 million in securities of issuers that are not affiliated with the entity: The allotment of shares to qualified institutional buyers shall be on proportionate basis.

Markets regulator sebi has proposed including 'systematically important' nbfcs and some registered family trusts in the qualified institutional buyers (qib) category, a move that. qualified institutional buyers are those institutional investors who are generally perceived to possess expertise and the financial muscle to evaluate and invest in. (zd) qualified institutional buyer means:

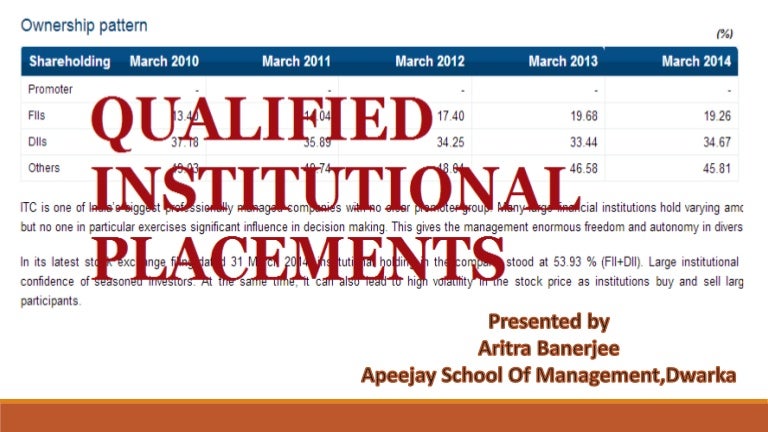

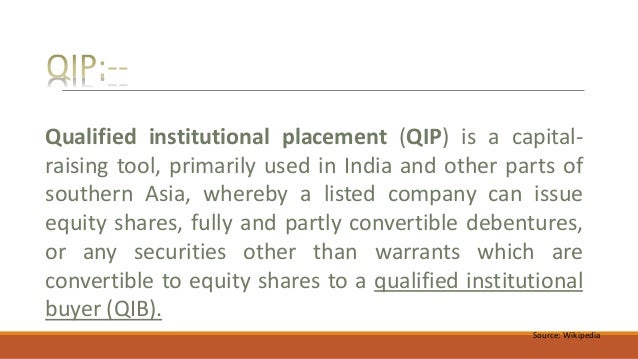

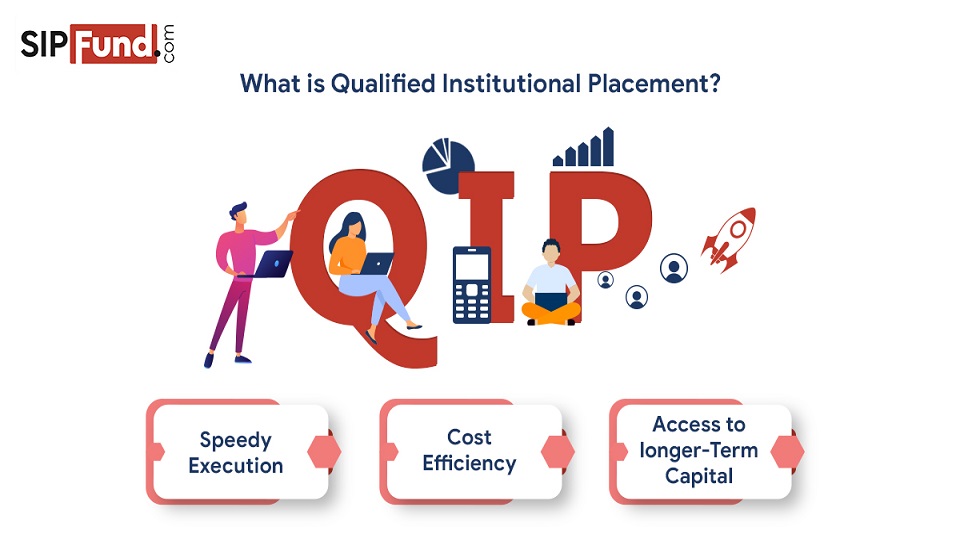

The retail investors had oversubscribed their share of the ipo by 1.66 times and qualified institutional buyers oversubscribed the ipo by 2.79 times. Go fashion ipo has been divided among qualified institutional buyers, non institutional buyers and retail buyers. Qualified institutional placement (qip) is simply the means whereby a listed.

More 15 may, 2021, 10.02 pm ist Qualified institutional placement (qip) is simply the means whereby a listed company can issue equity shares, fully and partly convertible debentures, or any securities other than warrants which are convertible to equity shares to a qualified institutional buyer (qib). Qualified institutional buyer (qib) shall mean:

Pdf Qualified Institutional Placements - An Exploratory Study In The Indian Context

All You Need To Know About Qualified Institutional Placement - Ipleaders

What Is A Qualified Institutional Buyer And How Are Qualified Institutional Buyers Regulated - Ipleaders

Capital Market Related Topics Regulatory Insights And Exchange Related Issues Psrao Associates - Ppt Download

All You Need To Know About Qualified Institutional Placement - Ipleaders

Qualified Institutional Placement Capital Raising Tool

Qualified Institutional Buyer Qib Definition

Qualified Institutional Placement Capital Raising Tool

Qualified Institutional Placement Capital Raising Tool

Lic Sbi Life Canara Bank Pick Up Stakes In Indian Bank Under Qip - The Hindu Businessline

Everything You Wanted To Know About Qualified Institutional Buyers - Ipleaders

What Is Qualified Institutional Placement Qip - Yadnya Investment Academy

Qualified Institutional Buyers Qib By Biz School - Youtube

What Is A Qualified Institutional Placement Qip

All You Need To Know About Qualified Institutional Placement Qip And Qualified Institutional Buyer Qib -atif Ahmed - Bw Legalworld

Everything You Wanted To Know About Qualified Institutional Buyers - Ipleaders

Everything You Wanted To Know About Qualified Institutional Buyers - Ipleaders

Rii Nii And Qib Difference Explained 2021 -

Securitisation And Reconstruction Of Financial Assets And Enforcement

Qualified Institutional Buyers India. There are any Qualified Institutional Buyers India in here.